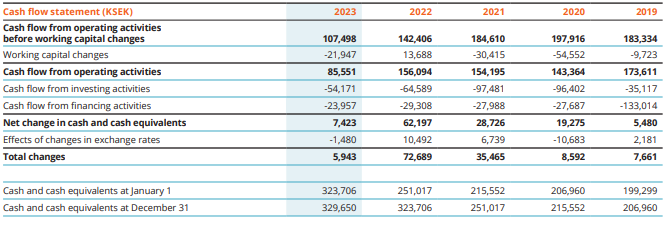

Definition of the alternative performance measures not defined in IFRS

The company presents some financial measures in the annual report that are not defined in IFRS. The company believes that these measures provide valuable supplementary information to investors and company management. Since not all companies calculate alternative performance measures in the same way, they are not always comparable with the measures used by other companies. However, these non-IFRS measures should not be considered substitutes for financial reporting measures prepared in accordance with IFRS.

The following alternative performance measures are presented:

Currency: SEK 000s unless stated otherwise

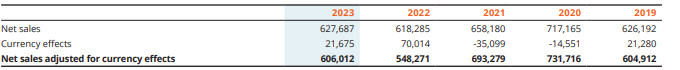

1. Net sales adjusted for currency effects

Net sales adjusted for currency effects is defined as net sales for the year translated at the preceding year’s exchange rates and is used to measure underlying net sales.

Calculated as net sales for the year adjusted with the effect of the preceding year’s exchange rates:

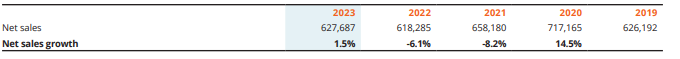

2. Net sales growth

Net sales growth is defined as this year’s net sales divided by the previous year’s net sales and is used to measure underlying net sales growth

Calculated as the year’s net sales divided by the previous year’s net sales:

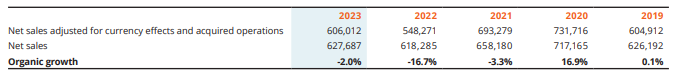

3. Organic growth

Organic growth is defined as the year’s net sales converted to the previous year’s exchange rates and excluding acquired operations divided by the previous year’s net sales and is used to measure underlying net sales growth.

Calculated as the year’s net sales converted to the previous year’s exchange rates and cleared for acquired operations divided by the previous year’s net sales:

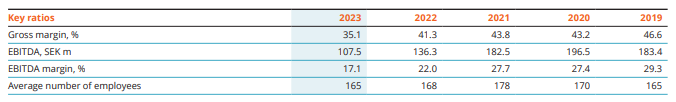

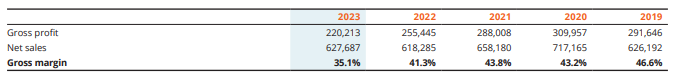

4. Gross margin

EBITDA is defined as operating profit/EBIT before depreciation/amortization and impairment and is used as a measure of the company’s profitability.

Calculated as operating profit/EBIT increased with depreciation/amortization and impairment:

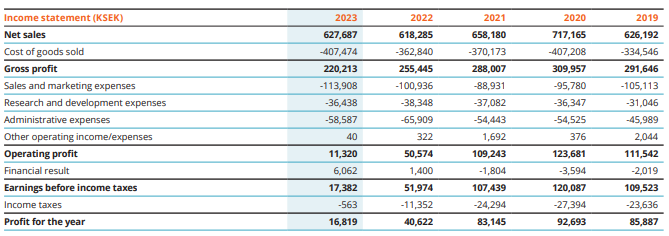

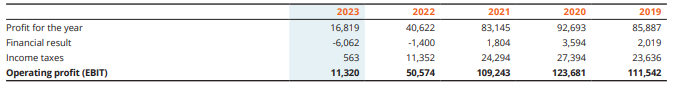

5. Operating profit (EBIT)

Operating profit/EBIT is defined as net income before financial income and expenses and tax for the period and is used as a measure of the company’s profitability.

Calculated as net income less financial income and expenses and tax:

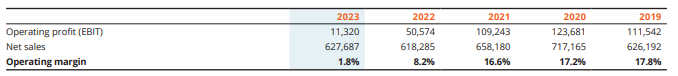

6. Operating margin

Operating margin is defined as operating profit divided by net sales and is used to measure the company’s profitability.

Calculated as operating profit divided by net sales:

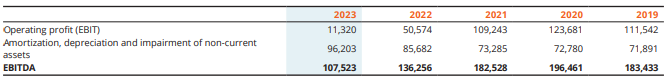

7. EBITDA

EBITDA is defined as operating profit/EBIT before depreciation/amortization and impairment and is used as a measure of the company’s profitability.

Calculated as operating profit/EBIT increased with depreciation/amortization and impairment:

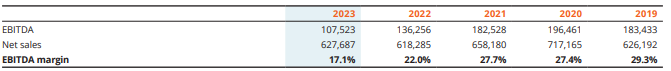

8. EBITDA margin

EBITDA margin is defined as EBITDA divided by net sales and is used to measure the company’s profitability before depreciation/amortization and impairment of tangible and intangible assets.

Calculated as EBITDA divided by net sales:

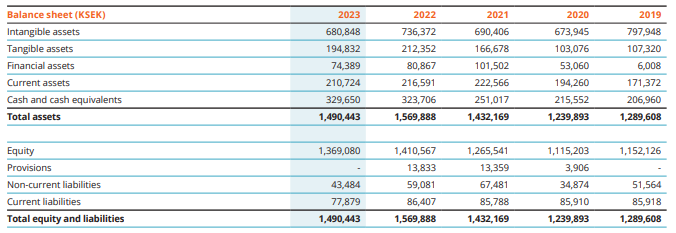

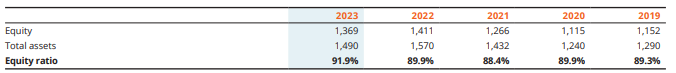

9. Equity ratio

Equity ratio is defined as Equity as a percentage of total assets at the end of the period and is used to show what proportion of the company’s assets have been financed with equity.

Calculated as Equity divided by total assets:

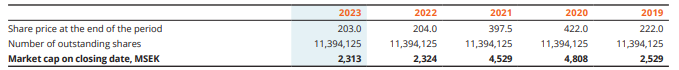

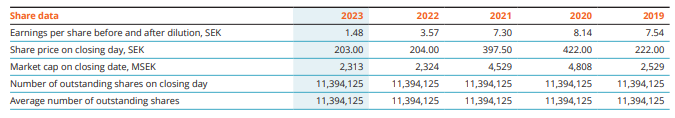

10. Market capitalization on the closing date

Market capitalization on the closing date is defined as the share price at the end of the period multiplied by the number of shares outstanding and is used to measure the company’s market capitalization at the end of the period.

Calculated as share price at the end of the period multiplied by the number of shares outstanding: